-

Free vs. Paid Delivery: What’s the Best Value for Your Cannabis Order?

Read more: Free vs. Paid Delivery: What’s the Best Value for Your Cannabis Order?In today’s competitive cannabis retail landscape, convenience is a driving factor in customer satisfaction—especially when it comes to delivery. Whether…

Blog

Read Our Latest Posts

-

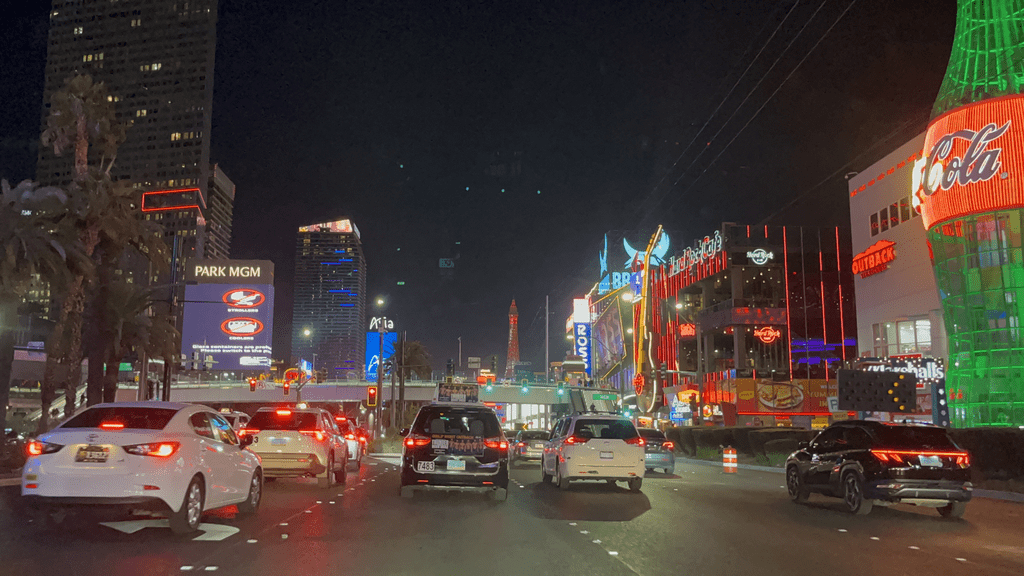

Should Vegas Casinos Embrace Dispensary Delivery Partnerships?

As of mid 2025, Nevada law explicitly prohibits cannabis delivery to non‑residential addresses—including hotels, resorts,…

-

The Future of Cannabis Delivery in the U.S.: A High-Tech Industry on the Horizon

With federal cannabis legalization on the table and rapid advancements in delivery technology, the future…

-

How COVID‑19 in 2020 Reshaped Las Vegas’s Cannabis Industry

When COVID‑19 struck Las Vegas in early March 2020, Governor Steve Sisolak declared a state of…