As of mid 2025, Nevada law explicitly prohibits cannabis delivery to non‑residential addresses—including hotels, resorts, and casinos. But what if that changed? Would casinos benefit from partnering with dispensaries to host delivery drop‑off zones? Let’s unpack the legal, economic, operational, and social angles.

1. The Legal Landscape: What’s Holding Us Back

Nevada law requires cannabis deliveries be made only to private residences, with no exceptions for gaming establishments. Dispensaries likewise refrain from hotel deliveries. There’s also a mandated 1,500 foot buffer between dispensaries and casinos. Any reform would need to adjust statewide delivery rules and zoning laws and—critically—convince casinos that federal gaming regulations won’t be violated by affiliating with cannabis vendors.

Recently, some casino leaders have begun calling for modernization. For instance, a proposal for in‑casino “kiosk pickups” has been drafted, but concerns remain over federal oversight and banking compliance.

2. Economic Upsides: Capturing Lost Revenue

Tourists consume—and buy—cannabis in Vegas, but with no legal delivery to casinos, many turn to the illicit market. Legal delivery drop‑off zones could:

- Redirect blackmarket demand into state taxed sales.

- Boost foot traffic as patrons stop to pick up orders from partnered zones.

- Add convenience-based loyalty, particularly among millennial and Gen Z guests accustomed to delivery culture.

Casinos could add modest revenue via location fees from dispensaries, with deliveries rolling directly onto or near the gaming floor.

3. Operational Hurdles & Casino Realities

But setting up a delivery zone partnership isn’t straightforward. Casinos would need to:

- Designate secure, controlled drop‑off areas away from gaming and customer traffic.

- Coordinate with dispensaries on timing, ID verification, and bagged pick‑ups.

- Ensure compliance with anti‑diversion measures—verifying IDs, keeping delivery drivers in unmarked vehicles, and tracking chain of custody.

Casinos may also worry about:

- Federal gaming regulations, which demand rigorous oversight and could interpret cannabis partnerships as jeopardizing federal licensing.

- Internal brand issues, as some operators may shy from association with a still–controversial substance.

- Pressure from regulators concerned about underage access or onsite consumption loopholes.

4. Social & Tourist Considerations

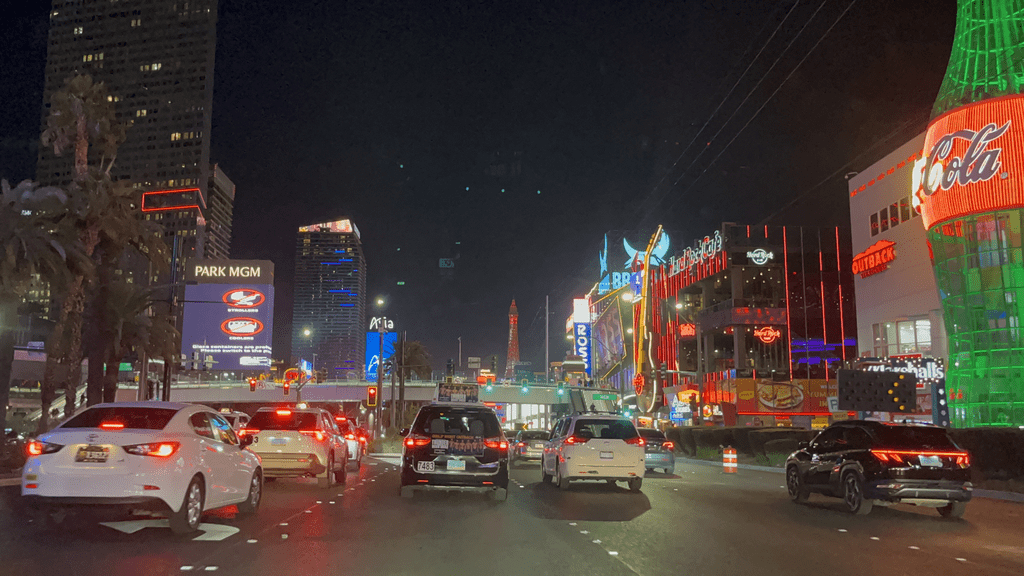

Vegas is evolving toward “cannabis inclusivity.” Off Strip, The Lexi boutique hotel openly markets itself as cannabis friendly, with designated rooms and plans for a lounge. Tourists increasingly expect convenience, and cannabis has become part of the Vegas lifestyle portfolio.

Offering legalized delivery zones on property could:

- Enhance tourist satisfaction, especially with remote or busy stays.

- Signal progressive branding, especially appealing to younger and leisure travelers.

- Provide safer access, steering folks away from unlicensed “dispensaries” masquerading on the Strip.

5. The Path Forward: Steps to Enable Change

To make this vision a reality, stakeholders would need to:

- Reform state delivery laws to allow drop‑off at regulated zones in non‑residential settings.

- Amend gaming licenses to explicitly permit controlled cannabis partnerships under federal compliance schemes.

- Establish clear operational rules, including security checks, driver training, and compliance reporting.

- Pilot a small scale test, perhaps at off Strip boutique properties before expanding to major resorts.

Legislators and casino advocates could collaborate through formal pilot programs—testing delivery “kiosks” in a handful of resorts under strict conditions.

Beyond The Lights

In a scenario where Nevada lifted its ban—allowing casinos to host licensed dispensary delivery drop‑off zones—it could be a win‑win. Tourists would gain seamless access; the legal market would reclaim revenue from black market sales; and casinos could enhance guest experience and generate ancillary income.

But the barriers are non trivial: federal gaming regulation, zoning restrictions, and compliance infrastructure all pose significant challenges. A thoughtful pilot program—backed by clear legal reform—could be the first step in determining whether this bold idea delivers on its promise.

Ultimately, if Nevada is serious about reducing illicit markets and modernizing Vegas tourism, it’s time to consider the question seriously: not if, but how can this partnership be implemented—and fast.